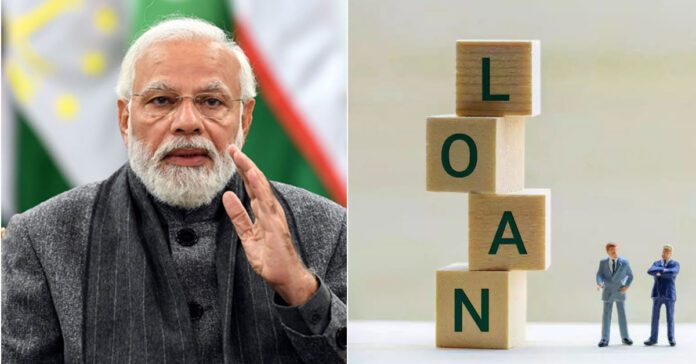

10 lakh crore corporate loans have been waived in the last five years by the Modi government. Unpaid debt in the bank’s account, i.e. corporate owners have taken loans from banks and have not paid them back. That amount has been waived by the government at the centre.

10 lakh crore loans waived off

Naturally, if 10 lakh crore is waived off the total non-performing loans accumulated by the banks, the amount of non-performing loans will come down. Banks can then claim that their NPA or non-performing loan burden has come down significantly.

“They want to show this as their operational success or efficiency.” And the finance minister bragged in her speech that it was because of her efforts that the banks were able to achieve this success.

Peoples’ money

The money given by the bank as a bank loan is not the personal money of the finance minister or bank officials. People of the country save their hard-earned money in banks.

That is the money that banks give as loans to corporate traders. Corporate owners receive money earned by the public through banks as loans. As always they do not pay that money and sit with their hands folded.

Interest on loans Increases

This is how the number of unpaid loans from the banks increases. The banks’ only source of income is interest on loans. When a corporate entity defaults on debt, income takes a hit as does capital. In this situation, when the government should take strict measures to recover the debt.

Instead of doing it, the Modi government is giving huge loot to the corporate by waiving the debt. But it is being promoted that the non-performing loans of the banks are decreasing.

Modi government

Notably, since the Modi government came to power, the amount of corporate loan waivers has increased gradually.

“2017-18 onwards, this Suit-boot government has written off loan worth 10 lakh crore, making the Public Sector Banks suffer a loss of more than 7 lakh crore”.

The Leader of Opposition in Rajya Sabha also shared a written reply to a question asked by him in the House on how much of bank loans were waived off during the last five years.

According to the answer to the unstarred question, given by Minister of State for Finance Bhagwat Karad, “As per Reserve Bank of India (RBI) on details of non performing assets (NPAs) written off by scheduled commercial banks (SCBs) during 2017-18 was Rs 1.61 lakh crore, during 2018-19 was Rs 2.36 lakh crore, during 2019-20 Rs 2.34 lakh crore, during 2020-21 Rs 1.57 lakh crore.”

“Almost in line with the pace at which corporate loan waivers have increased since the introduction of electoral bonds, corporates have funnelled huge sums of money into the BJP’s funds” through electoral bonds.

More significantly, the corporate tax rate has also been reduced significantly since the election campaign began.

ALSO READ: B L Santosh gets fresh notice from SIT, orders Telangana HC